How To Invest $100/Month For Passive Income In 2023

Let Me First Off Say, That I Am Not A Financial Advisor. This Is How I Would Invest $100/Month For Passive Income And It's Something I Am Currently Doing.

Video Version Of How To Invest $100/Month For Passive Income

What If You Do Not Have $100/Month To Invest In passive Income

That Is A Valid Question, And If You Do Not Have $100/Month To Start Buying Passive Income, Then You Need To Start Building Recurring Income.

We Have A Whole Training On How You Can Build Recurring In Our Digital Tycoon Program.

Which Is A Completely Free Program, Feel Free To Fill Out The Form Below:

An Easy Way To Invest $100/month For

Passive Income

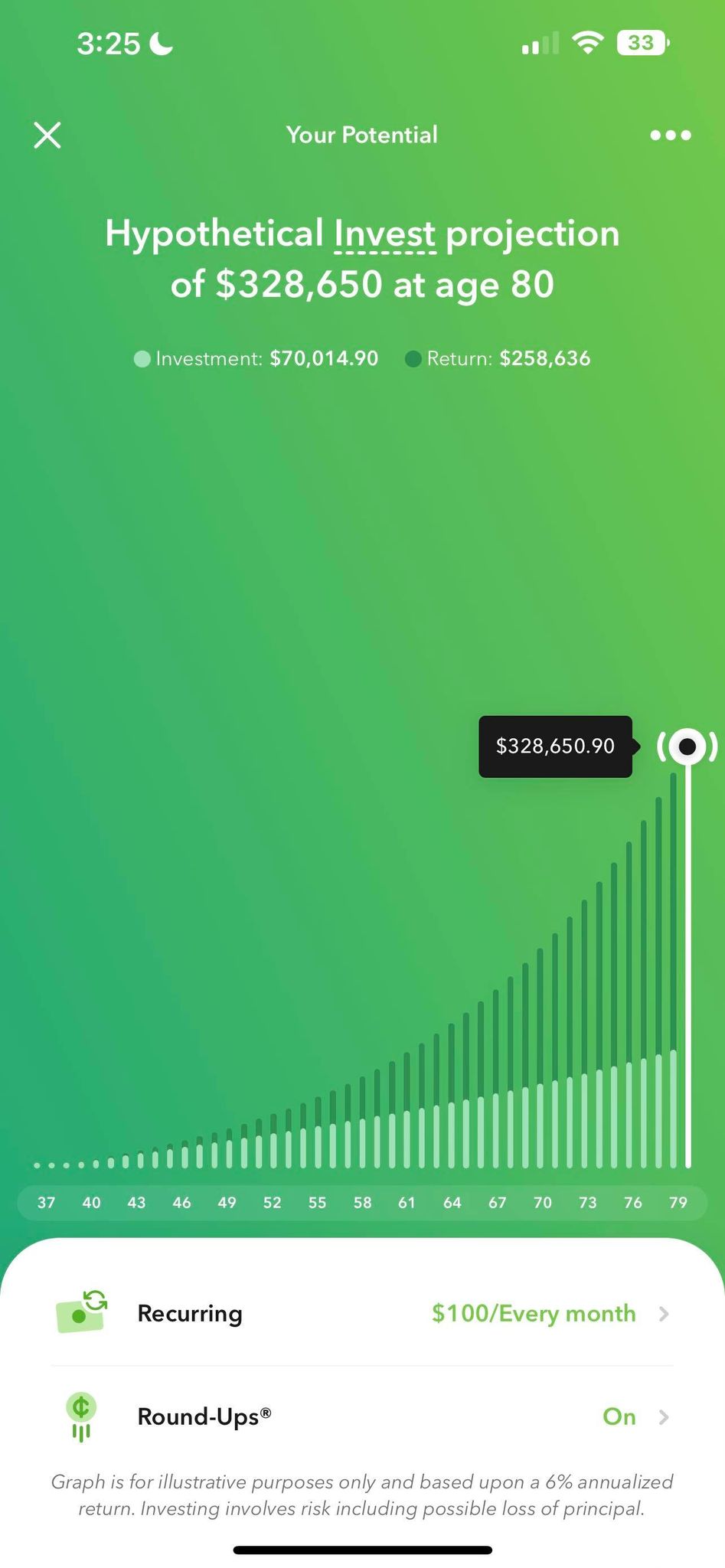

The Easy Set And Forget Method That I Use Is Acorns.

It's An Mobile App That When You Link It To Your Bank And Cards.

Will Round Up Each Purchase And Buy Stocks With The Amount.

There Is Also A Recurring Withdrawal Option.

That Is What I Set Mine Too.

Are There Other Ways To Invest $100/Month?

You Can Also Invest In Yourself And Join Our Accountability Group, If You Are Someone Who Has An Online Business.

We Have Ongoing Accountability Calls And Help Struggling Online Business Owners Get Results In Their Business.

>> Check Out Our Facebook Group.

Can I Invest $100/month In Crypto For Passive Income?

Of COurse You Can Invest In Crypto, One Of My Favorite Exchanges Is Kucoin.

I Have Alot Of Information Regarding Crypto For Your Viewing Pleasure.

Read It At https://wiki.themoneyfriends.com/

Which I'll Be Adding Much More Than Much Crypto To This Section, Now That I Think About It.

Using A Wiki Is A Great Resource And It's Free.

Also I Suggest Checking Out My Youtube Channel And Medium Since I Post There Quite Often Regarding Crypto.

>> Watch My Youtube

>> Read Some Medium Articles.

If You Have Debt, Then Do This With $100/Month.

Paying Down Bad Credit Card Debt Is By Far The Best Investment Since Most Credit Cards Are Between 15%-25% APR.

I Recently Used My Line Of Credit For $10,000 And I Was Paying $3 Every Single Day.

And That Was Around 11% APR.

If You Can Build Passive Income Like The Banks, Then You Need To Pay Off Your Bad Debt First Before Thinking of Investing $100/month.

How Much Can You Make By Investing $100/month

Ultimately It Depends On How Long You Invest For And What The Average Rate of Return Is.

Over 40 Years And Only Investing $100/month At A 10% ROI, You Are Looking At Around $300,000.

The Longer You Invest, The Money Begins To Just Multiple.

My Goals For Investing $100/Month

I Am Going To Continue To Put $100/Month Away In This While Also Investing In Crypto, And Then Also In A Dividend Stock Portfolio.

For Example:

If I Can Build Up Enough Dividends To Use To Pay For My Mortgage.

Then Buy Real Estate And Have The Rents Pay For My Life Style.

And My Businesses Be Using For Reinvest And So Forth.

If You Want To Learn More About Acorns I Did A Whole Review On It Here:

Want To Reduce Your Bills Check Out This Article

In Conclusion:

I'll Be Writing A Longer Article That I Will Link Down Here When I Get Things To A Level That I Am Happy With.

Be Sure To Join Our Group And Be Apart Of Our Circles.