Amazing Rocket Money Review (Formerly Truebill) – Best Way To Save On Subscriptions In 2022!

A program called Rocket Money, formerly known as Truebill, aims to save you money on your recurring expenses. In exchange, the business receives a portion of the money you save.

That initially appears to be a fair trade-off. This method isn't as easy as it seems, though, as with many other things in life. Before entrusting Rocket Money with managing your accounts, you should be aware of trust barriers and potential hazards.

Video Review Of True Bill Which Is Now Known As Rocket Money

Understanding How Rocket Money Works

Once What Was Truebill is Now Rocket Money.

How Rocket Money Works?

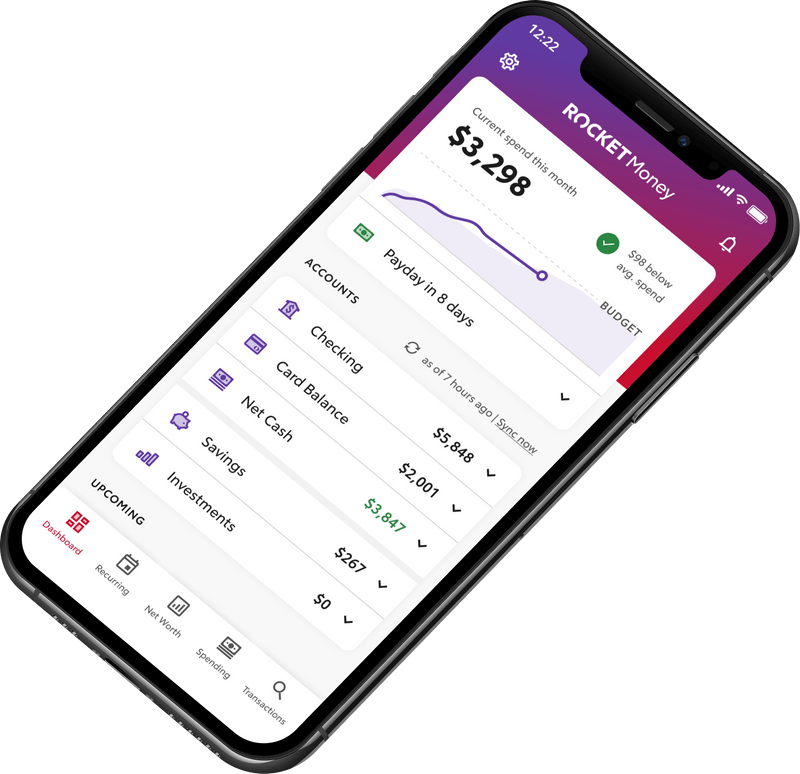

When you sign up for a Rocket Money account, you should first link your bank accounts and credit cards so that the software can track your transactions. Once you do that, they'll find all your subscriptions and recurring bills and put them in the app's "Recurring" tab.

From there, you can click on any Subscription to see more information and cancel any that you don't want. I stopped using streaming services and music apps, so I cancelled Netflix and Spotify. You can cancel yourself, or if you join Rocket Money Premium, their concierges will do it for you.

Rocket Money can also help you pay less for your bills. To do this, go to your Simple dashboard and click on the "TrueProtect" card. Then, add the bills you want to lower.

Premium users can also turn on Fee Refunds, which will make it so that when they get bank fees, our concierges will automatically ask for refunds.

Rocket Money adds new features all the time, and their goal is to be your one-stop shop for all your financial needs.

Let's face it: automating your finances can make your life a lot easier, but there are also some bad things about it.

For example, you can keep getting charged for a service you subscribed to even if you no longer use it.

This can be fixed with Rocket Money. By using your personal information, they can help you better handle your money.

There are many ways to save money with the Rocket Money app. Let's dive deep into them…

Previously Known As Truebill can be hard to handle money well.

Don't do it alone. Rocket Money gives you the power to save more, spend less, see everything, and get back in charge of your money.

Like Our True Bill Review / Rocket Money Review?

Rocket Money Features

Lowering Your Bills

You may have seen in its ads that Rocket Money is a free service. How you look at it probably makes a difference. You don't have to pay anything up front to let Rocket Money try to lower your bills, but without paying the company, you won't save any money.

As a "savings fee," the company takes 40% of every dollar saved with Rocket Money. T

his fee is charged once the savings are safe, and it covers a year's worth of savings. So, Rocket Money will charge you $200 if it cuts your bill by $500 per year. Rocket Money doesn't cost you anything if it doesn't help you save money. Rocket Money will ask you to add some of your monthly bills to its database when you sign up for an account. There are four steps to do this.

Manage Your Subscriptions

After you give Rocket Money some bills to look at, the next service it tries to sell you is taking care of your monthly subscriptions.

Rocket Money wants to be able to keep track of these through a bank or credit card statement.

It lets you add your favorite account through this dashboard screen:

Pay close attention to the disclaimer on this screen, which explains why Rocket Money wants to access your bank account.

The site says that your account will not be charged by Rocket Money. But keep in mind that the business already has your credit card number.

Here is a list of the subscriptions that Rocket Money says it can keep an eye on on your bank statements.

The idea is that Rocket Money will be able to find all of the monthly charges that keep coming out of your account and help you get rid of the ones you don't want.

You can cancel these subscriptions yourself, or you can pay for Rocket Money's premium service and have its "concierge team" do it for you. According to the most recent prices from Rocket Money, the premium service plans cost between $3 and $12 per month.

Smart Savings Accounts

Smart Savings is a feature that lets you move money from your checking account to a bank account that is insured by the FDIC. This helps you save money and reach your savings goals. You can set up automatic transfers, set limits so you don't overdraw, and take money out of your savings accounts at any time.

Is Rocket Money Safe To Use?

With 256-bit SSL encryption and read-only access, Rocket Money has the same level of security as a bank.

Rocket Money uses the Plaid service to connect to banks, so you don't have to give your banking information to Rocket Money directly.

Rocket Money knows that some people might be worried about the security risks that come with using the service. One of the most important tabs on its website is called "Security," and it tries to make you feel better about "handing over the keys" to your accounts.

Here are some of the most important things that the company said about security:

- Your information is encrypted with 256-bit bank-level security.

- The Plaid service is used by Rocket Money to connect with banks.

- Because of Plaid, Rocket Money shouldn't ask you for your banking information.

- Rocket Money says it won't give your information to other companies.

Amazon Web Services, where Rocket Money stores its data, also stores sensitive information for the U.S. Department of Defense (among others).

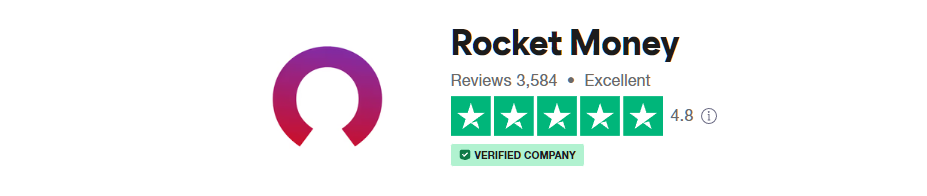

Trustpilot Review On Rocket money

Rocket Money Has An Excellent Rating With Trustpilot And Very High Reviews With Their Verified Company.

They Get Very Few Complements Compared To Other Companies On Trustpilot And Show Signs Of Always Communicating With Negative Communicates To Help Them With Any Issues They Might Have.

How the Better Business Bureau (BBB) Rates Truebill (Now Rocket Money)

I feel like I should add a disclaimer to this part of the review: "Truebill/Rocket Money is going through some changes."

As of July 2022, the Better Business Bureau had given Truebill a "B" rating, which means it was a member. That's a big improvement, but it's not as good as the "A" rating I saw when I checked on this article in December 2021.

On the BBB website, customer reviews of Truebill are getting better, but they still leave a little bit to be desired. As of July 2022, the company was rated 3.14 stars out of 5. That's better than the 1.61-star rating I found in December 2021.

I looked at the 85 complaints to learn more about what might be wrong with the service. There are some awful things that could happen. Details include complaints that Truebill took 40% of an internet bill discount that a customer negotiated over the phone and that Truebill renegotiated a cable, internet, and phone bundle to lower costs, which caused a cell phone plan to change without permission.

It's important to note that happy customers don't often tell the BBB about their experiences, but there are enough bad reviews here to make you feel a little uneasy.

How to get started

Rocket Money (formerly Truebill) has a lot of features you can use, but the first thing you need to do is create an account. You can do this by downloading the Rocket Money (formerly Truebill) app and entering your name, email address, and a password of your choice.

Step 1: Create an account with Rocket Money.

Make an account by going HERE. It's easy, and you can start right away.

Step 2: Look for the company that sends the bill

In fact, the list is pretty complete. As you can see from the screen shot above, Rocket Money can check prices for well-known companies like

- AT&T

- Charter

- Comcast

- and DirecTV.

The company says that 85% of the bills they try to negotiate are paid.

Step 3: Let Rocket Money see your monthly billing statements.

When it comes to online security, this step might make some of you feel a little queasy.

You can either connect your online billing account to Rocket Money by logging in, or you can upload a PDF or image of the bill.

Step 4: Give your contact info and turn on "TrueProtect."

Putting in a phone number is easy enough, but the "TrueProtect" program is what you should really pay attention to on this screen.

If you pick this option, Rocket Money will try to get a better price on this bill.

Some users have said that Rocket Money changes the details of things like cell phone plans and cable packages to save money.

Rocket Money Changing your plan could be hard if you lose channels or features you liked and thought were worth the extra money. And you'll still have to pay the 40% fee, even though the company will have technically kept its promise to reduce the bill.

Step 5: Authorize Rocket Money to charge your card.

Rocket Money will make sure it has a way to get its 40% before it does anything for you.

The company will only charge you if it is able to lower your bill.

But it seems likely that you could be charged for Rocket Money's share of a year's worth of savings up front, even though you'll only get those savings one month.

Final Thoughts: Is Rocket Money Worth It?

If you think you have a lot of subscriptions or bills that are eating up your money each month, Rocket Money (formerly Truebill) may be a cheap way to lower some of those costs.

It's not too surprising that this kind of app has paid features, but what makes Rocket Money (formerly Truebill) stand out is that the user can decide how much they want to pay for premium membership and how much of a cut the app gets for negotiating down bills. This could make it seem cheaper to more people.

But if you feel comfortable calling your banks and other service providers for your bills and negotiating lower payments on your own, it might not make sense to pay for Rocket Money (formerly Truebill) to do it for you.

Even though the reviews above were negative, Rocket Money could still help some people. Let's look at some pros and cons of Rocket Money to help you decide if it might be right for you.

Can you use Rocket Money? Rocket Money has found a lot of ways for its users to save a lot of money so far.

All you have to do is sign up, and you'll get money for nothing. Find out if Rocket Money is too good to be true in this review.

Taking care of money can be hard. With Rocket Money, it's easy to make the most of your money, keep track of your subscriptions, lower your monthly bills, and stay on top of your finances.

Rocket Money has helped more than 14 million people save money by finding and canceling unwanted subscriptions, lowering bills, and getting refunds for fees and outages.

Rocket Money is now available in the App Store for iPhones and in Google Play for Android devices.

In this review of the Rocket Money app, I wanted to find out if it IS safe and if we should use it.

Pros & Cons of Rocket Money

Pros

- Negotiates cell phone and cable bills, plus helps you get refunds for some bank fees

- Free version available

- Syncs to your bank accounts and credit cards

- Instantly finds and tracks your subscriptions

- Website says 80% of people save money by using Rocket Money (formerly Truebill) to find and cancel unwanted subscriptions

- Provides breakdown of user spending and notifies of upcoming charges and low balance alerts

- Helps users create a budget

- Users can see their Experian VantageScore 3.0 credit score and get access to their credit report

- Provides an interest-free pay advance up to $100 directly to qualifying users’ checking accounts

- Users can set goals, save money with autopilot Smart Savings feature

- Concierge service available to identify bills to be lowered and, for a fee, Rocket Money (formerly Truebill) will negotiate on users’ behalf for the best rates (non-refundable negotiation fee is anywhere from 30% to 60% of the 12-month savings achieved as a result of the negotiation)

- Rocket Money (formerly Truebill) Premium Service features include free access to Smart Savings feature, unlimited budgeting categories, custom spend categories, real-time account balance updates, premium chat, subscription cancellation concierge, “Truebill Offers” and educational material

- Coming soon: Users can track their net worth

- High Trustscore rating of 4.3/5 stars (from 392 reviews)

Cons

- Costs between $3 and $12 per month to upgrade to Rocket Money (formerly Truebill) Premium Service

- Non-refundable negotiation fee anywhere from 30% to 60% of the 12-month savings achieved as a result of Rocket Money’s (formerly Truebill) bill negotiation on users’ behalf

- Less than 10 Better Business Bureau reviews

- Does not negotiate internet, landline phones, cable/phone/internet bundles, alarm and security systems, satellite radio/TV or electric bills

FAQ About Rocket Money.

Who is Behind Rocket Money?

COTA Capital, Social Capital, Sherpa Capital, Day One Ventures, Y Combinator, and Cross are all investors in Rocket Money. The creators are:

Haroon Mokhtarzada

Co-Founder & CEO

Haroon got his law degree from Harvard and is now a business owner and angel investor. He was the CEO and Chief Product Officer of Webs.com, a popular site for making websites that had 50 million users before Vistaprint bought it and put Haroon in charge of digital product strategy. Haroon is very interested in tech startups, innovation, global change, and finding elegant solutions to problems.

Yahya Mokhtarzada

Co-Founder & CRO

Before joining Rocket Money, Yahya was the VP of Business Development at Nanigans, where he helped the company grow from less than $1 million to more than $20 million in annual revenue. Yahya is a mentor at 500 Startups, which is an incubator for new businesses. He helps early-stage businesses figure out their sales strategies, find the right product/market fit, and grow.

Idris Mokhtarzada

Co-Founder & CTO

Idris co-founded and helped grow Webs.com for more than a decade, until Vistaprint bought it in 2011. He has a number of patents on user interfaces that are based on graphics. Idris is an active angel investor in his spare time, and he is very interested in using technology for good in the world.

Is Rocket Money Legit?

If you're looking for Rocket Money reviews to find out if it's real, the answer is yes: Rocket Money is worth using, and it gives you a unique way to keep track of your spending. Over 2 million members have saved over $100 million with Rocket Money so far.

Subscriptions cost a lot of money every year, and apps like Rocket Money can give you information that will help you spend your money more wisely and always get the best deals.

Rocket Money has more features than other apps that let you cancel services, and upgrading to the paid version for a month might be all you need to decide if you want to keep paying for it or go back to the free mode.

This review of the Rocket Money app shows that it can help you save some of the money you spend every year. Try it out today, because it's a real thing.