Are you a Millennial who wants to take control of their personal finances? Are you looking for an app that will help track your spending and provide budgeting advice?

Truebill is the perfect tool for Millennials seeking financial freedom.

But just how safe is it, really?

In this article, we’ll explore Truebill in detail and discuss whether it’s a good fit for young adults or anyone else interested in taking charge of their financial future.

Millennials today are facing unprecedented economic challenges, including sky-high student loan debt and stagnant wages.

It can feel daunting to take back control of one's finances when so much is stacked against them. However, with the right tools at their disposal, Millennials can make sound decisions about their money and finally start getting ahead.

Truebill provides users with all the features they need to manage their money more efficiently. From tracking expenses and creating budgets to cancelling unwanted subscriptions, Truebill helps its users regain financial stability without breaking a sweat. But what makes it stand out from other similar apps? Is it secure enough to be trusted with sensitive information like bank accounts? Read on to find out!

Introduction

Are you looking for an easy way to manage your personal finances?

Truebill may be the answer. So, is truebill safe for anyone? Or just millennials? Let's explore how this popular app can help you improve your credit score, budget better, and keep track of your bank accounts.

Truebill claims that their users often save money on monthly bills, lower interest rates on debt, or get reimbursed from companies they've been overcharged by. For those struggling with personal finance issues such as high-interest loans and unnecessary fees, this could be a great solution.

The app also helps to monitor spending habits while providing tips and advice based on your financial goals.

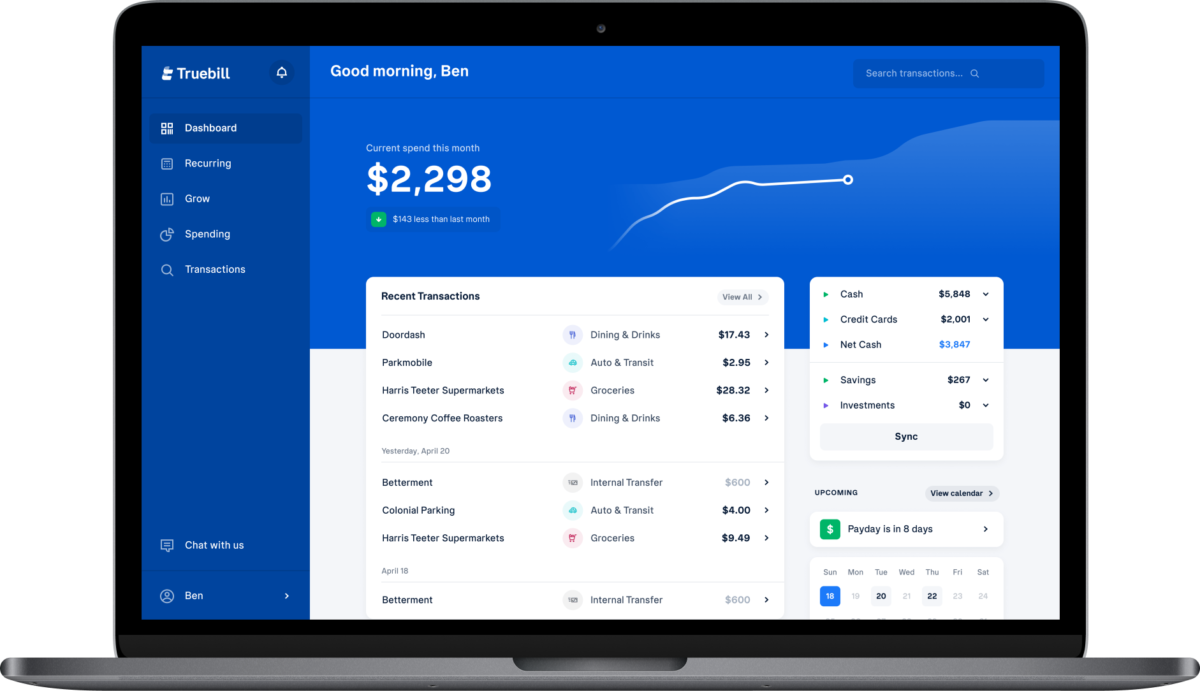

What makes Truebill stand out is its ability to provide real-time monitoring of all of your banking transactions in one place.

This includes tracking all activity related to ATM withdrawals, transfers between banks, deposits, and more. With this level of detail it's easier than ever before to stay organized with your finances and identify fraudulent charges quickly.

Plus, if there are any discrepancies or wrongfully charged items the customer service team will work hard to resolve the issue immediately.

The verdict: Truebill is definitely worth checking out if you're interested in taking control of your finances! Not only does it offer helpful features like bill reminders and budgeting tools but it also provides peace of mind knowing that everything is secure and monitored closely at all times. Even though the app was initially designed for millennials, everyone stands to benefit from using Truebill when managing their personal finances - regardless of age or income level!

The Internet Alerts: Is Truebill Safe In 2023?

As technology continues to evolve, the security of online services and apps becomes increasingly important.

Truebill is no exception - with the introduction of new features like credit card payment tracking and automated budgeting tools in 2023, it's essential that users feel confident their information is secure.

So how does Truebill measure up when it comes to safety?

The first thing you should know about Truebill is that your data is encrypted and stored securely on servers protected by state-of-the-art firewalls.

This means all financial transactions are safeguarded from any cyber threats or malicious attempts at accessing sensitive information.

Plus, if something ever did happen, the customer service team would be ready to help you out right away.

Truebill also has a number of other measures in place to keep your rocket money safe.

For example,

they offer two-factor authentication for added protection against unauthorized access as well as an activity log feature which allows users to view their monthly budget history including deposits and withdrawals.

The app also monitors suspicious activity such as large transfers between bank accounts so customers can rest assured knowing their finances are always accounted for.

Overall, there’s plenty of evidence that Truebill takes its security seriously – meaning you don't need to worry about keeping your personal data safe when using the app!

With robust encryption protocols and extra layers of protection built into the system, you can trust that your hard earned dollars will remain secure no matter what happens.

Looking ahead, we can confidently say that Truebill provides one of the best experiences available when it comes to managing finances safely and responsibly in 2023. Now let's look at how much this great service costs each month...

Is Truebill Good I Chat With A Google Friend Of Mine?

Truebill has become a popular budgeting app for good reason. It offers features designed to help users take control of their financial future, such as automated fee refunds and potential savings opportunities through its Amazon Web Services partnership.

The interface is intuitive, making it easy to understand exactly where your money goes each month, while the customer service team provides timely support when needed. Plus, since Truebill utilizes bank-level encryption protocols and secure connections via Plaid, you can rest assured that your data will remain safe throughout the entire process.

The app also helps eliminate paperwork associated with traditional banking services by automatically tracking all transactions and categorizing them based on user preferences. This allows for greater accuracy in terms of spending habits and makes it easier to monitor progress towards long-term goals like debt reduction or saving for retirement.

And best of all, Truebill won’t break the bank - there are no hidden fees or commissions involved – so you can enjoy peace of mind knowing that every penny spent on subscriptions is well worth it!

In addition to these great features, Truebill boasts an impressive suite of tools which make budgeting and investing simpler than ever before.

From bill reminders and personalized savings accounts to automated transfers between banks and credit cards - this powerful platform puts everything at your fingertips without requiring any extra effort from you.

Whether you're looking for ways to track expenses more accurately or just want to keep better tabs on overall financial health - Truebill has something for everyone!

How Much Does True bill Per Month?

So, you're sold on the safety features of True bill and want to know what it'll cost each month.

Rest assured, the app offers a variety of plans that can fit any budget - from basic services to premium options.

The first plan is free and comes with unlimited tracking of your monthly bills as well as smart savings recommendations tailored specifically for your lifestyle.

With this option, you won't have to worry about overspending or missing payments ever again! The next step up is their paid membership which gives access to additional features like automated budgeting tools and credit score monitoring.

This service costs $9.99/month but also includes special discounts when shopping online at select retailers.

For those who need even more functionality out of their financial management software, there's also a premium version available for just $19.99/month in addition to other exclusive benefits such as 24/7 customer support and personalized investment advice from certified professionals.

It’s important to note that all memberships come with complete access to the desktop and mobile versions so users can manage their accounts wherever they go!

No matter which plan you choose, Truebill provides an easy-to-use platform for keeping track of expenses while still enjoying peace of mind knowing your data is secure.

So if you're looking for a comprehensive yet affordable way to stay on top of your finances in 2023, then look no further than Truebill – the ultimate solution for managing money wisely!

How Much Should I Pay For True bill

When it comes to budgeting and keeping tabs on spending habits, there's no better solution than True bill. The app offers a variety of plans that are reasonably priced and tailored to fit any lifestyle - from basic services to premium options.

For those who want the most comprehensive financial management experience, there’s the Premium subscription at $19.99/month.

This plan gives access to all features of the free version as well as exclusive benefits like 24/7 customer support and personalized investment advice from certified professionals.

It also includes bill negotiation with companies so users can get rid of hidden fees or lower their monthly bills for an even greater savings!

At only $9.99/month, you can upgrade your account to gain additional features such as automated budgeting tools and credit score monitoring – ensuring that you stay financially responsible while still enjoying peace of mind knowing your data is secure.

Whether you're looking for basic tracking or more advanced capabilities, Truebill has something for everyone in 2023!

But if you don't need extra bells and whistles right away, then the Free option might be just what you need; this entry-level package provides unlimited tracking of monthly bills along with smart saving recommendations tailored specifically for each user's individual needs. No matter which plan fits best into your budget however, rest assured that Truebill will always provide an easy-to-use platform designed to help manage money wisely in 2023!

What Does True bill Charge Me

True bill offers a variety of plans, all designed to help you reach your financial goals. The most comprehensive experience comes with the Premium subscription for $19.99/month - which includes 24/7 customer support and personalized investment advice from certified professionals. This is perfect for those who want access to extra features like automated budgeting tools or credit score monitoring without having to worry about hidden fees or monthly bills.

For a more basic tracking option, there's the Free account - which gives users unlimited bill tracking as well as smart saving recommendations tailored specifically for their individual needs. And if you're looking for something in between these two options, then Truebill also has an upgraded plan at just $9.99/month that will provide even greater savings opportunities while still keeping your data secure through its connections with trusted financial institutions.

But what sets Truebill apart from other services?

According to reviews on sites like Rocket Money, it’s clear that this app stands out due to its excellent customer service and user-friendly interface - making budgeting easier than ever before! Plus, unlike some other companies out there, Truebill guarantees 100% satisfaction by providing quick refunds when needed so customers can rest easy knowing they’re getting exactly what they pay for each month.

Whether you opt for one of the paid packages or use the free version of the app, one thing is certain: you won't have any problems finding ways to save money with Truebill! With customizable alerts and helpful tips built into every plan, it's no wonder why people everywhere are using this powerful tool to make smarter decisions about their finances – now let's see how much cash we can really put back in our pockets…

Does Truebill Actually Save You Money

When it comes to budgeting, one of the most important tools you can have is a reliable app like Truebill. By connecting with your cell phone and bank accounts, this powerful budgeting app helps users identify potential savings opportunities - from renegotiating existing bills to finding discounts on services like cable or internet.

This means that no matter what your financial situation looks like, there's always something you can do to lower your monthly expenses. Plus, Truebill also provides helpful tips and advice so you can stay up-to-date on any changes in the market that could affect your spending habits.

But how does Truebill actually save you money?

The answer lies in its ability to effectively track all of your bills and subscriptions; by recognizing patterns over time, it can alert users when they're paying too much for certain products or services. Additionally, the app will provide personalized recommendations based on each user's individual needs - allowing them to take control of their finances without having to waste valuable time searching for deals online.

Finally, Truebill makes budgeting easier than ever before by providing an easy-to-use dashboard where users can keep an eye on all their transactions at once. From bill payments and subscriptions to investments and savings goals – everything is accessible directly within the platform! So regardless of whether you’re just starting out or already managing multiple accounts, Truebill has got you covered every step of the way towards achieving financial freedom.

By combining these features with its secure connection to trusted institutions and 24/7 customer support, it’s clear that Truebill offers a comprehensive solution for anyone looking to get their finances under control quickly and easily. Now let’s explore exactly how this budgeting app goes about lowering our bills…

How Does Truebill Lower Your Bills

Truebill is designed to save users money by helping them create and maintain unlimited budgets, as well as identify potential savings opportunities. The app’s intuitive dashboard allows you to monitor all of your expenses in one place, while the personalized recommendations provide useful insights on how much you should be spending each month – ensuring that you never overspend again!

The app also offers a premium version which provides access to additional tools like bill negotiation services. These services work by analyzing existing bills and subscriptions for any extra fees or charges that can be removed. Truebill will then contact vendors directly on behalf of the user, leveraging their experience with these companies to negotiate better prices. This way, users can rest assured knowing they are getting the best possible deal available at all times!

But what if you already have a subscription that you no longer need? In this case, Truebill can help too! With its easy-to-use cancellation feature, it takes just a few clicks to cancel any unwanted service - meaning that users won't have to worry about making those difficult phone calls ever again. Plus, since Truebill has such an extensive network of partners, chances are good that it'll be able to find suitable alternatives for most people's needs.

All in all, it's clear why so many people trust Truebill when it comes to managing their finances; from budgeting and tracking down discounts to cancelling unwanted subscriptions - this powerful platform helps anyone take control of their financial future without breaking a sweat!

Can Truebill Really Cancel Subscriptions?

The answer is a resounding yes! With Truebill, you can easily cancel any unwanted subscriptions and recurring bills with just a few clicks. The app's premium chat feature allows you to get in touch with their dedicated customer service representatives who will be more than happy to help guide you through the cancellation process.

This way, users don't have to worry about dealing directly with the service provider – leaving them free to focus on other areas of their finances.

But that's not all; Truebill also provides detailed analytics which make it easier for customers to identify any potential savings opportunities. By highlighting hidden fees or charges in existing subscription plans, users can then decide whether or not they should switch providers - potentially saving even more money in the long run.

Plus, since this whole process is automated, it eliminates the need for manual tracking - meaning that users won't have to waste time keeping tabs on their spending anymore!

Not only does Truebill offer powerful features like these but its intuitive interface makes managing your finances simpler than ever before.

From creating custom budgets and setting up reminders for upcoming payments, to finding discounts and cancelling unwanted services - there's no denying the power behind this platform when it comes to taking control of one’s financial future.

Ultimately, these are just some of the reasons why thousands of people trust Truebill as an important part of their overall budgeting strategy.

It offers unparalleled convenience and accuracy while still providing users with unprecedented levels of flexibility – making it a truly invaluable tool for anyone looking to save money each month!

Is Truebill Fdic Insured

Truebill is not FDIC insured, however it does provide an extra layer of security for its users by using the Plaid service.

This allows them to securely connect their banking credentials without having to worry about any sensitive information being stored or shared with a third party.

Additionally, Truebill also offers savings accounts that are secured through partner banks - allowing customers to earn interest on their money while keeping it safe from unauthorized access.

On top of this, Truebill also takes measures to ensure user data privacy by utilizing strong encryption protocols and other advanced technology solutions.

As such, customers can rest assured knowing that all of their financial details remain secure at all times - giving them complete peace of mind when managing their finances within the app.

At the same time, it's important to note that Truebill doesn't offer the same level of protection as traditional banks do.

While they have implemented various security measures in order to keep customer data safe, there may be some risks associated with trusting your personal financial information completely online. Therefore, it's always best practice to use caution when connecting your bank account or credit card details with any type of digital platform – especially those outside of the traditional banking system.

Ultimately, Truebill provides users with a convenient way to manage their finances without sacrificing safety or privacy along the way. With its powerful features and robust security protocols in place, you can easily take control over your spending habits and save more money each month - no matter what stage you're at in life!

Is There A Better App Than Truebill?

When it comes to budgeting apps, Truebill is definitely a top contender.

However, there are many other options out there that may suit your needs better than Truebill – depending on what you’re looking for in an app.

For example, if you’d like to track more detailed budgeting categories or have access to additional features such as bill reminders and automatic payments, then some of the alternatives available on Google Play might be worth considering.

At the end of the day, it all comes down to personal preference and which app best fits your lifestyle. Some people prefer complex tracking systems with lots of bells and whistles while others value simplicity above all else when managing their finances. Whatever your individual requirements may be, take time to read through reviews before making a decision so that you can find the perfect fit for you.

In terms of security measures, most apps offer similar levels of protection - but Truebill stands apart from its competitors due to its unique combination of services. From bank-level encryption protocols to secure connections via Plaid, customers get peace of mind knowing that their financial data remains safe no matter how they use the app.

Additionally, users also benefit from various savings accounts offered by partner banks – allowing them to keep their money protected whilst earning interest at the same time!

So whether you're after a simple way manage expenses or a comprehensive suite of tools tailored towards budgeting success - Truebill offers something for everyone. And with extra layers of security in place too, you can rest assured knowing that your hard earned cash will always stay safe within this digital platform.

Frequently Asked Questions

What Types Of Services Does Truebill Provide?

Truebill is an innovative financial management platform that helps users take control of their finances.

It offers services for tracking spending and setting budget goals, managing subscriptions and recurring payments, finding savings through canceling unwanted expenses or reducing bills, protecting your credit score, and more.

Truebill makes it easy to stay on top of one's finances while also offering peace of mind when it comes to security.

The range of services provided by Truebill are designed to help maximize a user’s financial potential. From improving credit scores to helping identify areas where they can save money on monthly expenses, the platform provides powerful tools that can be used to simplify personal finance decisions.

Additionally, Truebill offers tailored advice on how best to manage one’s finances in order to make informed decisions about investments and other long-term strategies.

In terms of safety features, Truebill safeguards customer information with bank-level encryption technology, keeping all data secure from unauthorized access or misuse.

The company takes great care to ensure that its customers' privacy is respected at all times; this includes using two-factor authentication whenever necessary and notifying customers if there are any changes made in their account settings.

In addition, Truebill has implemented additional measures such as fraud detection algorithms which monitor activity 24/7 for suspicious activity related to the accounts linked with Truebill.

At the end of the day, Truebill puts you back in charge of your own financial destiny – allowing you to make smarter choices with greater confidence than ever before.

With its comprehensive suite of offerings, users can rest assured knowing that their finances will always remain safe and secure within the confines of Truebill's secure system architecture.

Is There A Limit To The Number Of Bills I Can Manage With Truebill?

Do you ever feel overwhelmed by the sheer number of bills you have to manage? Do your finances sometimes seem out of control, leaving you feeling helpless and frustrated? If so, Truebill may be the anser.

Truebill is a service that helps people take back control of their finances. It allows users to easily monitor and manage all of their bills in one place. With Truebill, you can set up automatic payments for each bill, track spending trends over time, and even negotiate lower rates with some providers.

But one question remains: Is there a limit to the number of bills I can manage with Truebill? The simple answer is no! With Truebill, there are no limits on the number of bills you can track or manage. So whether it's five or fifty different accounts, Truebill has got you covered.

What's more, using Truebill is 100% secure - meaning your financial data and personal information remain safe at all times.

And if that wasn't enough incentive to get started right away, they also provide helpful customer support whenever needed. So why wait any longer? Sign up today and start taking control of your finances with Truebill!

Is There A Minimum Amount Of Time I Need To Use Truebill For?

Are you ready to get the most out of your finances with Truebill? The answer is yes. But, if you're wondering how long does it take for Truebill to be effective, then the answer can vary.

Truebill doesn't have a minimum time requirement that needs to be met before seeing results, but there are some key steps and features that can help maximize the effectiveness of managing your bills with Truebill.

First off, setting up auto-payments will ensure you never miss a payment or incur late fees again. Auto-payments also make sure you always pay on time, which helps keep your credit score in good shape. You'll also want to set up recurring reminders so you know when payments are due — this way, you avoid any penalty charges from forgetting about them!

Additionally, using Truebill's "Find Savings" feature allows users to easily search for discounts and lower rates on their current services.

This means no more overpaying on things like cell phone plans or cable packages; instead, Truebill searches through hundreds of providers to find deals tailored specifically to each user's budget and needs. Plus, they offer one-on-one assistance should users need extra help finding savings opportunities.

From saving money on monthly expenses to avoiding costly late fees and penalties - Truebill makes financial management easier than ever before.

Whether it takes two weeks or two months of usage for you to start seeing real financial progress, it all starts by signing up for free today!

Does Truebill Provide Customer Support?

Wondering if Truebill provides customer support? You're not alone. Many people who are looking for a way to manage their finances and save money want to know that they have access to reliable help when needed.

Truebill offers 24/7 online customer service, so you can get answers quickly whenever you need them.

They also provide phone-based advice from experienced advisors available during office hours. So, whether your question is big or small, Truebill has you covered.

But it's more than just having someone on the other end of the line - Truebill takes your privacy seriously as well! All interactions with customer service representatives are conducted using secure protocols, ensuring your personal data remains confidential at all times.

The bottom line is this: If you're looking for financial guidance and peace of mind, Truebill provides top-notch customer support in a safe and secure environment.

With fast response times and knowledgeable staff members ready to answer any questions you may have, you won't be stuck without assistance anytime soon!

Does Truebill Offer Any Discounts Or Promotions?

Are you looking for discounts or promotions from Truebill? Good news – the answer is yes!

Truebill offers a variety of discounts and promotions that can help you save money.

Whether it's on subscriptions, fees, or other services, they have something to offer everyone.

Truebill helps customers take advantage of available savings opportunities.

They provide personalized recommendations so you can get the most out of your money. Plus, their platform makes finding deals easy and fast. You'll never miss an opportunity to save again!

With Truebill’s discounts and promotions, it doesn't matter if you're a millennial or not; anyone can benefit from their offerings.

Many people are surprised at how much they can save with these programs. It's a great way to make sure your hard-earned money goes farther each month.

So what are you waiting for? Take advantage of all the amazing benefits Truebill has to offer today! With just a few clicks, you could be saving big time - so don't hesitate to explore all the ways in which Truebill can help put more cash back in your pocket.

People Also Ask What Are The Pros Of Truebill

Truebill is a great financial app for anyone who wants to take control of their finances. It offers an intuitive interface, bank-level encryption protocols and secure connections via Plaid that ensure your data remains safe throughout the process. Plus, with automated fee refunds and potential savings opportunities through its Amazon Web Services partnership, you can make sure you’re getting the most out of your money.

The app also helps eliminate paperwork associated with traditional banking services by automating transactions and categorizing them based on user preferences.

This makes it easier to track expenses more accurately while giving users insight into where they stand financially, enabling them to reach long-term goals like debt reduction or saving for retirement faster than ever before.

Truebill won't break the budget either - there are no hidden fees or commissions involved so it's a win-win all around!

What really sets Truebill apart from other budgeting apps is its impressive suite of tools which make tracking spending habits easier than ever.

From bill reminders and personalized checking accounts to automated transfers between banks and credit cards – this powerful platform puts everything at your fingertips without requiring any extra effort from you.

For example, Rocket Companies' integration allows users to use Truebill as their primary account management system for all of their investments in one place, meaning less time spent managing multiple accounts individually.

Overall, Truebill provides a comprehensive set of features designed to help users keep better tabs on overall financial health and easily manage their day-to-day expenses with accuracy and efficiency.

With plenty of options available and more being added regularly - now may be the perfect time to give this innovative app a try!

People Also Ask

Is Truebill actually good? Is Truebill Safe As They Say.

Yes It's A Great Software That Saves People Money And Time And Gives Them A Roadmap to Financial Freedom. You Can Sign Up For Today And Start Saving Money Within Just A Few Weeks! It Makes All The Difference.

Any Outage On Truebill? Is Truebill Safe Then?

Truebill Is Always Up And Working, If You Are Having Connection Issues Please Contact Support.

Does Truebill have A Refund Policy?

Yes They Do, You Can Review It here: Truebill Or RocketMoney Refund Policy

Does Truebill Lower Bills With AT&T, IOS, Comcast, DirecTV

Sign Up And See How Much They Can Save You

Is There Any Cons To The Premium Service / Concierge

You Should Sign Up And See If It Is Something That Works For You.

Do You Have A Rocket Money Review?

Coming Soon.

Do I Need To have Specific Download OR Upload Speeds?

Check With Your Carrier, Fees Might Apply.

Are You Rated With The Better Business Bureau (BBB)

Yes they are rated With The Better Business Bureau

Conclusion

Truebill is a convenient and secure way to help manage your finances.

It provides services such as bill tracking, budgeting and saving money on subscriptions, while also offering customer support you should email them.

It can be used by anyone regardless of age or income level, with no limit to the number of bills you can track simultaneously.

Furthermore, Truebill does not require users to commit for any length of time;

use it when needed and cancel at any time without penalty.

Finally, Truebill offers discounts and promotional codes from time to time so that customers can save even more money.

Overall, Truebill is an excellent tool for managing your monthly expenses in a safe and reliable manner. Its user-friendly platform makes it easy for everyone to understand their financial situation, which is especially helpful if you are new to budgeting or need assistance understanding how much you spend each month. Additionally, its security features ensure that none of your personal information will ever be compromised.

With all these benefits combined, there’s no reason why anyone shouldn't give Truebill a try!