50 30 20 Budget Rule

If You Are Someone Who Is Looking To Set Up A Budget Or Start Saving Money, The 50 30 20 Rule Is Your Go To Method For Beginning To Budget Your Money. Sometimes Known As The 50 20 30 Rule This Rule Will Give You A Simple Method to Manage Your Money And We Will Break It Down For You Right Now.

Watch the video below:

What is the 50 30 20 Budgeting Rule?

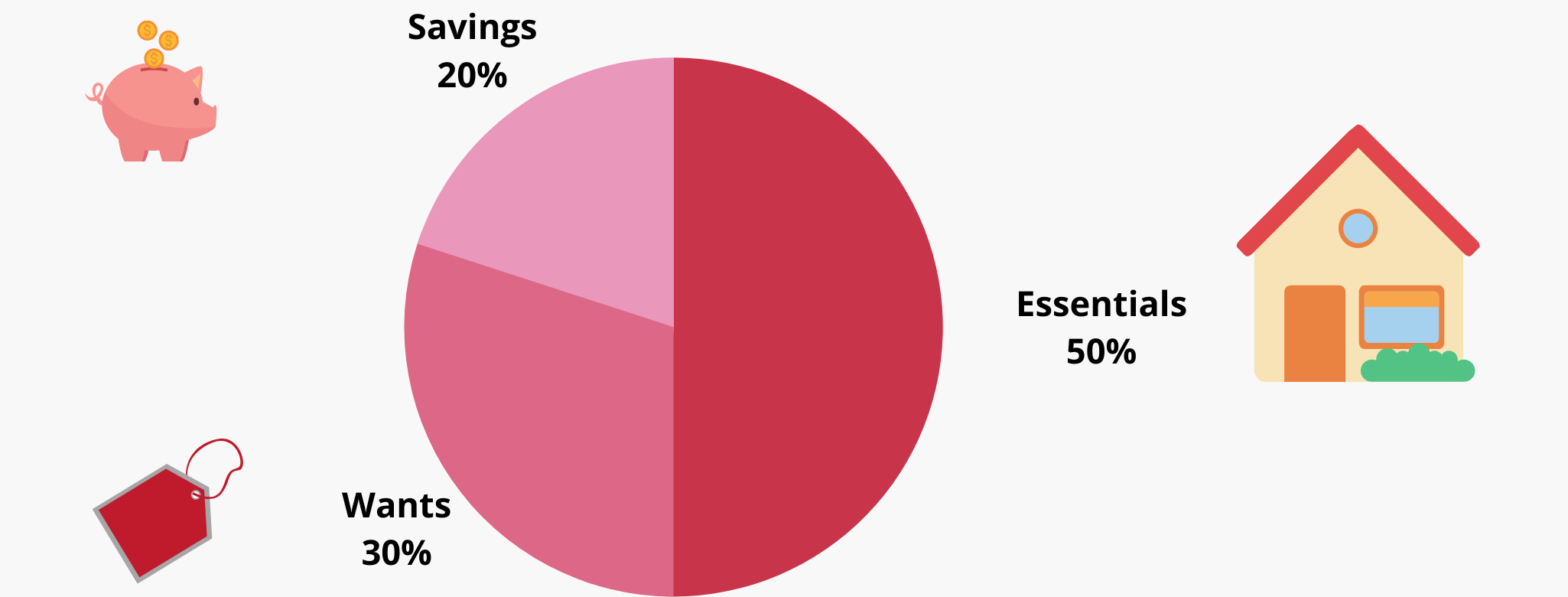

The Simplest Way To Explain The50 30 20 Rule Is Dividing Up Your Income Into three Buckets.

The First Bucket Is Your Essentials Or Necessities, Such As Housing/Shelter, Food, Utilities, Transportation, Insurance, Etc. Things You Typically Need To Function Day To Day. It Also Includes Your Minimum Payments On Any Debts You Have, Since Not Paying Them, Can Cause Some Serious Consequences.

These Debts Are Like Your Car Loan, Credit Cards, Student Loans, And So Forth. These Expenses Shouldn't Take Up Anymore Than 50% Of Your Take Home, And The Goal Is To Make Sure We Do Not Exceed These.

The Next Bucket Goes Towards Savings Or Extra Payments On Your Debt, Since Our Goal Is To Pay Off Our Bad Debt As Quickly As Possible.

Some Of These Savings Contributions Could Be A 401k, IRA, Rental Property, Etc. Savings Is For Long Term Wealth and Not For Vacations, New Cars or Anything That Would Be Considered A "want" .

The Final Bucket Which Is Your 30% Budget Are Your "Wants" or "Life Style Bucket". These Things Are Such As Vacations, Entertainment, Hobbies, Eating Out, Cell Phones, And Everything That Make You Look Rich And famous. Joking.... Never Buy Things To Impress People

What's The Difference Between The 50 30 20 Rule And The 50 20 30 Rule?

I Know At First Glace This Might Be A Little Confusing Between The Difference Between The 50 30 20 Rule And The 50 20 30 Rule. When It Comes Down To These Two Rules, But They Are Essentially The Same Exact Rule, Just The Wants And The Savings Are Switched.

Essentials: 50%

Savings: 30%

Wants: 20%

How to Budget with the 50 30 20 Rule

Remember This Is A Rule Of Thumb, And As Your Money Increasing Your Numbers Will Shift, But It's A Starting Point.

The Goal Is This Rule Of Thumb Is To Fast Track You Out Of Debt, By Creating An Easy To Follow Framework That Allows You To Look At Your Spending Habits And Make Tweaks To Put You On The Right Path of Financial Freedom.

As I Mentioned earlier, As Your Income Increases These Numbers Will Shift. The More Money You Make The More You Save, And The Percent Of Your Needs Will Drop But Depending On your Lifestyle, Your Wants Could Go Up.

For Example: Someone Who Is Making $30,000 A Year Vs Someone Making $300,000 A Year Will Have Much Different Spending Habits So The 50 30 20 Rule Might not Apply To Them.

I Have Noticed That Many Of My friends, Who make More Money Tend To Spend More On Luxuries, But Tend To Live Pay Check To Pay Check. This Is A Common Mistake, And Could Be Corrected By Just Saving More, And Paying Off Bad Debt.

Before I Ever bought My Own House, I Bought Rental properties To Create Long Term Financial Wealth.

I would Say We Are Above The Average In Our Income And Find This Rule A Very Useful Rule To Follow No Matter What Your Income Level Is, If You Are having Trouble Getting Out Of Debt.

Getting Out Of Debt Is Soul Sucking And It Should Be The First Thing You Should Aim For, Since It Puts Alot Of Strain On Many Peoples Lives. Thing About It.. Before We Are Out Of College We Typically Have Over $25,000 In Debt Between College, Car Loans And Credit Card Debt... That Is INSANE

Here Are The Stages You Should Be Aiming For.

- Live Frugal: When You Are Just Starting Out In Life, You Should Try And Live As Frugal As Possible. You Usually Don't Have Many Debts Or Liabilities So Reducing Your Expenses As Much As Possible. Cut Things Out Like TV, Streaming Services, Tobacco Products, Pricing Cell Phone Plans, And Wasteful Utilities Usage.

- Increasing your income: Increasing your Income Can Be Harder Than Some Think But For Others, Having A Side hustle Is Super Easy And Rewarding. There Are Numerous ways To Make Passive income Or Add Additional Income Stream So That You Can Fit More Into The 50 30 20 Rule Spending Habbits.

Resource: 2 Passive Income Streams And 1 Income Stream That Help With The Above 2 Points. - Getting Out Of Debt: This is A Huge game charger for most people. If they can pay off all their bad debt and starting reinvesting all their money into income producing assets, it changes the game for many people. This was My First Priority And Still is A Priority For Me, regardless Of Good Debt Or Bad Debt. We Currently Own 10 Rental Properties And have "Good Debt" But It Still Reduces Out Cashflow.

- Retiring Early: For Me, I Don't Care To Work All My Life. Spending Time With My Family, Going On Vacations And Traveling The World Sounds Like Alot of Fun To Me... If We Had All Our Rental Properties Paid off, And Our Own home Paid Off; Then We Would Be Able To Both Be Retired Early. That Is Something We Are Currently Working On Even Though We Own Alot of Income Producing Assets.

Why Is A 50 30 20 Rule Budget Necessary?

To Be honest, it's not... budgeting is not necessary. however most people are bad at money. it's kind of like exercise, most people know how to get in shape. It's really only a 2 step process.

1. eat healthy

2. Exercise.

But Actually Doing It Is A Whole Different Thing. Getting Out Of Debt Is A Three Step Process.

1. Reduce Spending

2. Increase Income

3. Pay off Debts.

However, Some People Will Say "It's Easier Said Than Done", But In Reality It's Not. I Actually Never Knew Of The 50 30 20 Rule When I Started Getting Into Money. I Only Recently Learned About The 50 30 20 Rule And Thought It Was An Amazing Concept For Those Who Need A Framework To Follow, And Figured I Would Share It With It. Start budgeting money so that you can know where your money is going.

But This Blog Post Has Every Single Resource You Need To Follow The 50 30 20 Rule And Become Financially Free So That You Can Retire Early And Get Your Time Back.

Necessities vs. lifestyle choices when budgeting Money.

When You Start budgeting Money, Someone People Can't Decide If Something Is A Lifestyle Choice Or A Necessity. For example when it Comes to Housing Expense. Many People Will Buy The Biggest And Coolest Apartment or The nicest car that they can afford but that becomes a lifestyle choice and not the best use of our money. Make sure you are budgeting money every single day so that you know if your lifestyle choices follow the 50/30/20 rule.

PRO TIP: Consider Your Time. Sometimes it might be worth living closer and paying more than having to drive an hour each way to and from work in order to save a few hundred dollars on rent. These extra hours could actually help you make more money when you are creating a side hustle.

Having A Nice car is also a lifestyle choice because if you are just driving back and forth to work, than it's just more expensive to maintain that vehicle.

I remember when I was a personal trainer and i had a BMW and had to pay 91 octane for gas. Higher insurance, and maintenance was EXPENSIVE. was it worth it? no.

Spending Habits.

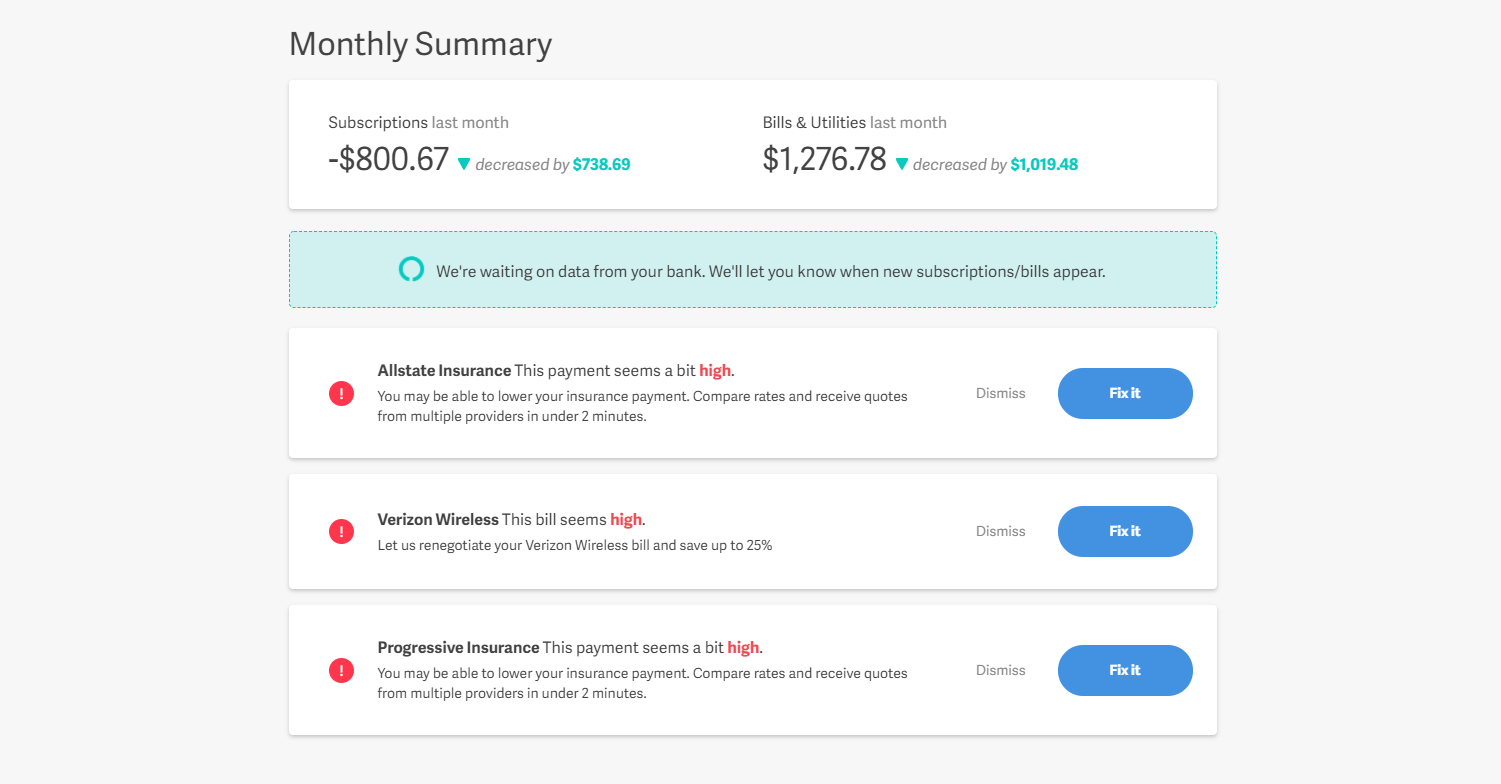

When You Are Budgeting Money And Implementing The 50 30 20 Rule, You Really Need To Understand Where Your Money Is Going. A Website Like Truebill.com Which Will Help Remove Subscriptions Or Lower Your Bills

Another Tool is Mint.com Which Will Break Down Your Spending Habits, So You Can See Where You Spend The Most and Where You Should Probably Cut Back.

Wants Vs Needs

When You Are Budgeting Money, And Using The 50 30 20 Rule, it's Important To Understand Your Wants And needs, And Strictly To This Budget. FOMO is a Real Issue in A Social media Age, but there is plenty of time to really start saving money and making sure that you are able to get the most out of your Spending Habits.

Everyone Wants The Latest And Greatest Thing, but this isn't always the best decision and that is why the 50 30 20 rule is such a good framework to follow because it gives you the ability to have your wants within a certain fraction of your income.

the 50/30/20 Rule Right for You?

When I Was A Personal Trainer, I noticed My clients were able to train with me at 10 or 11am and haven't started work yet. I thought everyone started work at 8 or 9am but these guys didn't even have to go into the office. They were able to have the freedom of going into the office anytime they wanted because they had the financial freedom that many people have to wait till 65 to ever retire.

even then most people continue to work because they have to relay on social security or some other means to be able to pay off their monthly expenses while reducing their life style by alot.

i didn't want to be that person. I wanted to be able to have the freedom in life at the age of 40 to spend time with my family and never worry about paying for college, buying my family a new car or making rent.

so let me ask you... is the 50/30/20 rule or financial freedom something that you actually want to achieve?

Like I Mentioned Before, I Never Have Used The 50/30/20 Rule Because I Didn't Know It Existed When I Was Saving Money. I Am Frugal By Nature, So Most Of My Money Goes Into Investing In Real Estate So I Would Say That The 50/30/20 For Me Is More

50% Savings/Investing

30% Needs/Essentials

20% Wants.

But That Is Also Due To The Fact, I have Alot Of Rental Income.

Where Does Your Money Go?

Every Few Months, I Take A Look Over My Expenses And See Where I Can Save Money.

Can I Call My Bank And Reduce My Monthly Fee?

Can I Ask Them To Waive My Yearly Card Fee?

Am I Able To Reduce My Insurance, Phone Bill Or Whatever Else In Order To Save Me A Few Hundred Dollars Every Single Month?

The Answer Is Yes. You Can Negotiate Your Monthly Bills Are The Time. Reassessing Your Needs And Wants Every Few Months Can Save You Thousands Every Year And Get You Better Aligned With The 50 30 20 Rule Framework.

Are You Budgeting Money Correctly?

If You Are Using Mint and Truebill, Then You Are On A Good Start To Knowing Where your money goes and implementing the 50 30 20 rule in your life. For Me, I wanted To Make Sure That Most Of My money Was Going To Investing So That I could Become Financially Free.

If You Understand Money, Then You Are Doing Better Than 90% Of the World Because Most People Don't Understand good Debt Vs Bad Debt, Leverage or Even rules of thumbs like the 50 30 20 rule.

Budgeting Money Is The First Step understanding how many works and what your money is doing. if you don't understand where your money is going or what it is doing you have a big problem. start budgeting money correctly!

The Most Important Thing Was My Freedom

I Love What I Do, I Get To Play On Facebook All Day. I Write Blog About Money, Or Even Do Youtube Videos About Making Money Online Or Creating Wealth. It's Very Laid Back And I Feel Very Fortune That I Have That Freedom But Having The Freedom To Know That I Could Give That Up And Travel The World For A Month And Spend Any Amount Of Money I Want To Experience Everything In Life Is Really Getting The Most Out Of Life.

I Wanted The Freedom To Do Whatever I Wanted, When I Wanted. If I Wanted To Take A Day Off. I Would Take The Day Off.. And I Want That For Everyone.. That Is Exactly Why I Provide Information Like The 50/30/20 Rule So That Everyone Can Become Financially Free.

IF you Plan To use The 50 30 20 rule, make sure that you understand where your money is going, and don't feed into Shiny Objects or FOMO Behaviors. If You Are someone Who Likes To Impressive Other people With The things you buy or the clothes you wear, or the car you drive, then you probably won't do very good with budgeting and saving... because it's just not sexy.

Recently, we went to new orleans completely for free ( for the most part) because we have saved so many points from using out credit cards for all our expenses and then paying them off each month.

Frugal Is Sexy.

Just Kidding It's Not... But Down The Road, When I am traveling the world, all the time, it will be. If You Have ever added me On Facebook or Seen me On Instagram, you will notice that i pretty much wear the same stuff and have the same clothes for the last 3 years.

my wife actually has to spend my money to get me new clothes because i am a pretty frugal person. if its not broken why fix it right? they don't have holes, and they still fit me... so i think they are fine. But It's because I Budget Money Correctly, and make sure that i follow the 50/30/20 rule that fits my needs.

I Try And use the 50 30 20 rule when it comes to investing since i am trying to reduce my needs and wants and invest more of my income into income producing assets. then all my assets will be able to pay for all my essentials needs and wants because my income will be much greater due to the Appreciation and debt pay down with real estate.

My Final Thoughts on 50 30 20 Rule

I Think the 50/30/20 rule, 50 20 30 rule or whatever you want to call it is a great rule of thumb but when it comes down to it you need to understand money. If you don't understand money or how budgeting money works or where your money goes each month, it doesn't matter what number you use.

Most People just keep their money out of sight, out of mind and that is the worst way to manage your money because you need to understand where each and every dollar goes so that you understand what your expenses are. Start Budgeting Money and Make Sure That You Know Where It Goes every single month so that you are able to start saving your money and reinvesting it into income producing assets.

Frequently Asked Questions About Budgeting Money And 50/30/20 Rule.

Some Questions I get About Budgeting Money And the 50/30/20 Rule.

what are the best Budgeting Money Apps?

I Listed Them before, but The Ones I use Are Mint.com and truebill.com

Is The 50/30/20 Rule The Only Rule For Budgeting Money?

The 50/30/20 rule isn't the only rule to budget money, there are many other cashflow tactics/budget money tactics, that you can use to save money. I WIll List Some Of Them Below, With A Brief Explanation.

- 1Envelope Method - This Method For Budgeting Money requires you to put all your cash into envelops based on the categories and only spending what is in those Envelopes.

- 2Zero Sum Method- This Is Another Method For Budgeting Money In Which You Take Your Income And Your Expenses And Write Them Down And Zero It Out Each Month, By Defining Where Each Dollar Goes Each Month.

- 3“Pay yourself first” budget - Is Typically The Way I Am budgeting money by investing most my money. The strategy is where you pay yourself first and then all your expenses come second. This strategy for budgeting money is similar to the 50/30/20 rule since most of my money pays me first. I Am budgeting money or Paying myself first by investing most of my income.

- 4Priority-based budget - Is The last method I am going over for budgeting money, since it's based on what you value first. I left this last for budgeting money since not Everyone's Priorities are the same, and typically if you look at people spending habits.. its not about budgeting money.. its about buying things to make them "happy".

Does The 50/30/20 Rule Work?

Yes The 50/30/20 rule works...But it's not magic, you need to actually implement it.

Is The 50/30/20 Rule The best rule for budgeting money?

I Think That The 50/30/20 Rule Is A Great Strategy for those who will implement it and take the time to actually look at their expenses and income and Separate them into groups.

When Can I Start The 50/30/20 Rule?

Today! You Can Use The 50/30/20 Rule At Any Stage of Life... It's About Taking Action.

Is The 50/30/20 Rule....

Whatever you Want To Ask.. The 50/30/20 Rule or Any Budgeting Strategy Can Help, If You Choose the 50 30 20 rule or zero sum or whatever, just start budgeting money so that you are able to use that money to reinvest.